Introduction

The accounting and finance sector has always been shaped by technological evolution. From ledger books to ERP systems, each wave of innovation has reduced manual effort and improved decision-making. Now, the rise of Agentic AI — AI systems capable of autonomous decision-making, adaptive learning, and proactive task execution — is driving the next leap forward.

Agentic Workflow Automation goes beyond traditional robotic process automation (RPA) by empowering AI agents to not only follow instructions but also interpret goals, adjust to new conditions, and recommend (or take) actions that improve business outcomes. In finance and accounting, this translates to faster processes, more accurate reporting, and strategic insight that was previously human-exclusive.

1. What Is Agentic AI in Finance and Accounting?

Agentic AI refers to intelligent systems that act with agency — meaning they can:

Understand objectives and context

Plan and prioritize tasks

Learn from outcomes

Adapt to changing requirements without explicit reprogramming

In finance and accounting, this might include AI agents that:

Monitor cash flow patterns and autonomously adjust forecasts

Detect compliance risks and initiate mitigation steps

Optimize tax planning based on evolving regulations

Unlike static automation, Agentic AI doesn’t just execute — it decides and improves.

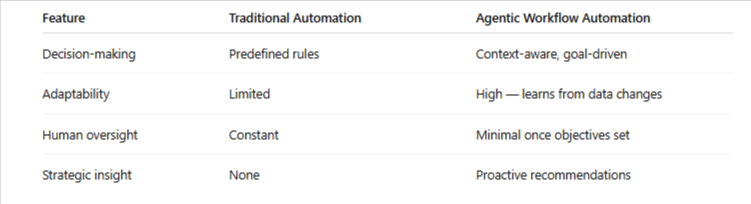

2. How Agentic Workflow Automation Differs from Traditional Automation

For example, while RPA might automate invoice data entry, an Agentic AI system could detect payment anomalies, renegotiate vendor terms, and adjust cash reserves — all autonomously.

3. Core Applications in Finance and Accounting

3.1 Autonomous Financial Forecasting

Agentic AI models analyze historical performance, market trends, and operational data to generate forecasts that adapt in real time to new inputs, like changes in interest rates or customer demand.

3.2 Intelligent Compliance Monitoring

Instead of manually checking regulations, Agentic AI can monitor evolving accounting standards and automatically update compliance workflows, reducing the risk of penalties.

3.3 Smart Expense Management

These systems can classify expenses, identify cost-saving opportunities, and alert teams to overspending without being explicitly programmed for every scenario.

3.4 Tax Optimization

Agentic AI can dynamically assess multiple tax strategies and select the most beneficial approach based on current rules, jurisdiction, and company goals.

4. Benefits for the Finance Function

Enhanced Efficiency – Processes that once took days can be completed in minutes.

Greater Accuracy – Machine-led decision-making reduces human error in reconciliations, reporting, and compliance checks.

Proactive Insights – Financial leaders receive forward-looking recommendations, not just historical reports.

Scalability – AI agents can handle growing transaction volumes without proportional increases in staffing.

5. Challenges and Considerations

While the potential is significant, organizations must address:

Data Quality – Agentic AI’s effectiveness depends on clean, integrated financial data.

Ethical & Regulatory Compliance – AI-driven decisions must align with audit and transparency requirements.

Change Management – Finance teams require training to trust and collaborate with AI agents.

Cybersecurity – Autonomous systems need robust safeguards to prevent misuse or breaches.

6. The Future of Agentic AI in Finance and Accounting

In the coming years, Agentic Workflow Automation will likely evolve from assisting human accountants to becoming a core driver of financial strategy. CFOs may rely on AI-generated forecasts for boardroom decisions, while auditors could interact with AI agents to validate controls and compliance in real time.

Forward-thinking finance and accounting leaders are already piloting these systems, ensuring they’re prepared for a future where AI is not just a tool — but a decision-making partner.

Conclusion

Agentic AI in Finance and Accounting marks a transformative shift from rule-based automation to intelligent, autonomous operations. By embracing Agentic Workflow Automation, finance functions can move beyond repetitive tasks toward proactive, insight-driven strategies that create competitive advantage.

Organizations that prepare now — investing in quality data, governance frameworks, and workforce adaptation — will lead this new era of financial intelligence.

FAQs

Q1. How does Agentic AI differ from RPA in accounting?

RPA automates repetitive tasks based on fixed rules, while Agentic AI adapts to context, learns from outcomes, and can make autonomous decisions.

Q2. Is Agentic AI suitable for small accounting teams?

Yes. Cloud-based AI tools make Agentic automation accessible to smaller teams, helping them achieve efficiency without large headcount.

Q3. What’s the biggest risk in adopting Agentic AI for finance?

Poor data quality and lack of governance can lead to incorrect decisions. Proper data management and oversight are essential.

Q4. Can Agentic AI improve audit readiness?

Absolutely. It can track compliance in real time, maintain complete audit trails, and flag irregularities proactively.

Write a comment ...